Business Succession Planning

It is essential that your valuation advisor be qualified, independent and experienced to meet the rigorous standards to qualify as an expert witness in a court of law, and to competently defend the appraisal report under cross-examination by attorneys on the witness stand before a judge.

When developing a succession plan for your business, you must make many decisions. Should you sell your business or give it away? Should you structure your plan to go into effect during your lifetime or at your death? Should you transfer your ownership interest to family members, co-owners, employees, or an outside party? The key is to pick the best plan for your circumstances and objectives, and to seek help from financial and legal advisors to carry out this plan.

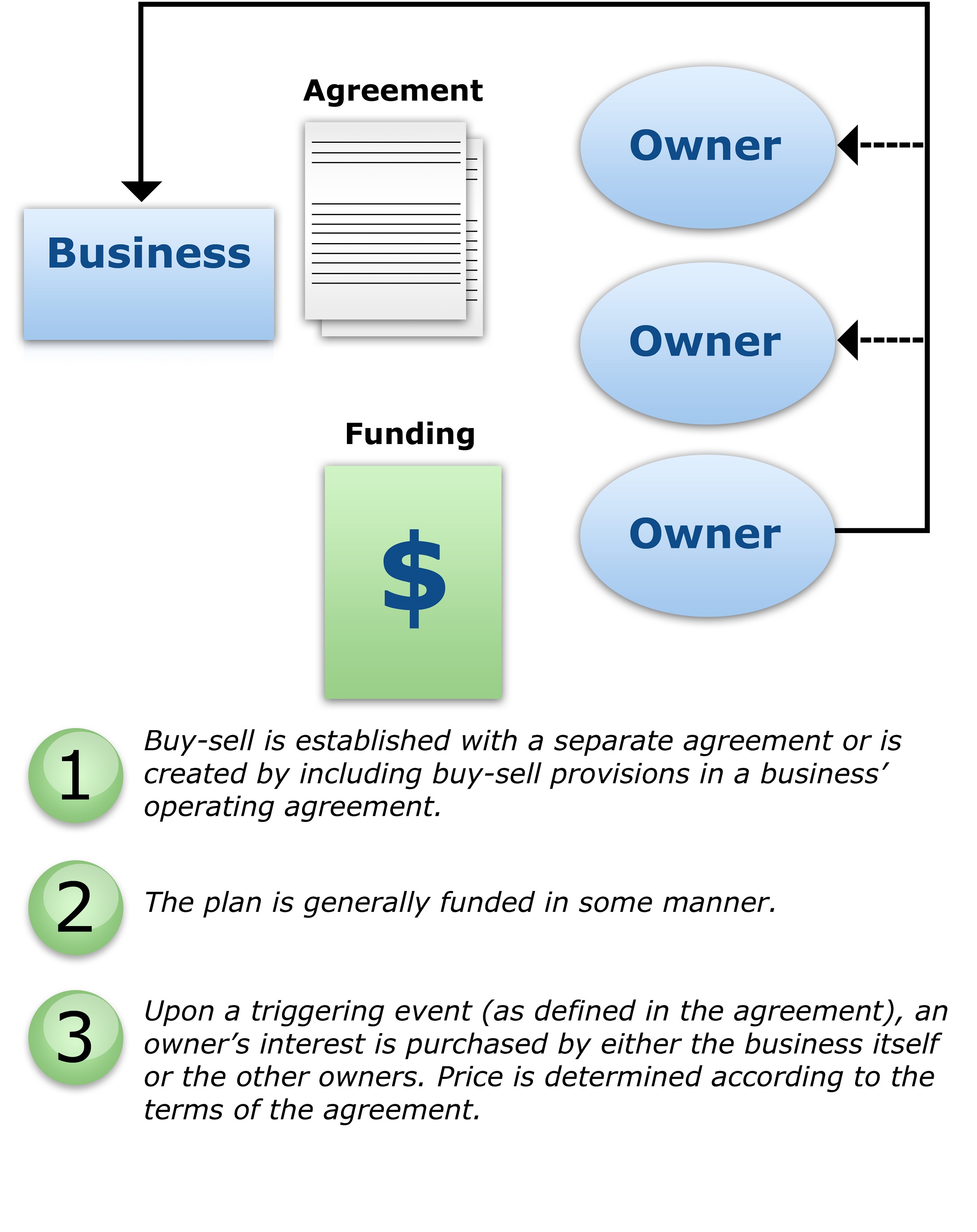

A buy-sell is a legally binding contract that establishes when, to whom, and at what price you can sell your interest in a business. A typical buy-sell allows the business itself or any co-owners the opportunity to purchase your interest in the business at a predetermined price. This can help avoid future adverse consequences, such as disruption of operations, entity dissolution, or business liquidation that might result in the event of your sudden incapacity or death. A buy-sell can also minimize the possibility that the business will fall into the hands of outsiders.

The ability to fix the purchase price as the taxable value of your business interest makes a buy-sell agreement especially useful in estate planning. Agreeing to a purchase price can minimize the possibility of unfair treatment to your heirs. And, if your death is the triggering event, the IRS’ acceptance of this price as the taxable value can help minimize estate taxes.

Additionally, because funding for a buy-sell is typically arranged when the buy-sell is executed, you’re able to ensure that funds will be available when needed, providing your estate with liquidity that may be needed for expenses and taxes.

With a private annuity, you transfer your ownership interest in the business to family members or another party (the buyer). The buyer in turn makes a promise to make periodic payments to you for the rest of your life (a single life annuity) or for your life and the life of a second person (a joint and survivor annuity). Again, because a private annuity is a sale and not a gift, it allows you to remove assets from your estate without incurring gift or estate taxes.

Until 2006, exchanging property for an unsecured private annuity allowed you to spread out any gain realized, deferring capital gains tax. IRS regulations proposed that year have effectively eliminated this benefit for most exchanges, however. If you’re considering a private annuity, be sure to talk to a tax professional.

Gifting your business

If you’re like many business owners, you’d prefer to have your children inherit the result of all your years of hard work and success. Of course, you can bequeath your business in your will, but transferring your business during your lifetime has many additional personal and tax benefits. By gifting the business over time, you can hand over the reins gradually as your offspring become better able to control and manage the business on their own, and you can minimize gift and estate taxes.

Gifting your business interests can minimize gift and estate taxes because:

• It transfers the value of any future appreciation in the business out of your estate to your heirs. This can be especially valuable if business growth is expected.

• Gifts of $14,000 (in 2014 and 2015) per recipient are tax free under the annual gift tax exclusion.

• Aggregate gifts up to $5,430,000 (in 2015, $5,340,000 in 2014) are tax free under your lifetime exemption.

• Partial interest gifts, as with GRATs, GRUTs, and FLPs, may be valued at a discount for lack of marketability or restrictions on transferability.

Gifting your business using trusts

You can make gifts outright or use a trust. You can even structure a trust so that you keep control of the business for as long as you want. You can establish a revocable trust, which will bypass probate and allow you to change your mind and end the trust, or an irrevocable trust, such as a grantor retained annuity trust (GRAT) or a grantor retained unitrust (GRUT) that can provide you with income for a specified period of time and move your business out of your estate at a discount.

Gifting your business using a family limited partnership

Frequently Asked Questions

I own a business. Are there any creative ways I can use life insurance in my business?

You might consider purchasing a key-person life insurance policy that covers the loss of services when a key employee or partner dies. The benefits can be used to cover any lost profit and the cost of replacing the employee or partner. The insurance is owned by your business, which also receives the benefits.

Another way to insure against the death of a business partner is through a buy-sell agreement. For example, three partners in a business each own the same amount of stock. One partner, Mr. Clark, dies, and his stock goes to his wife through his will. If the business had written a buy-sell agreement and funded it with life insurance, the surviving partners would have received a life insurance benefit when Mr. Clark died. The partners and Mrs. Clark could then have exchanged the life insurance benefit for the company stock.

Split-dollar life insurance is another benefit you can offer your employees while investing in your company. Here, the business purchases a life insurance contract on the life of an employee and shares the cost. If the employee dies, your business receives an amount equal to the premiums paid, and the employee’s beneficiary receives the remaining death benefit. If the policy is surrendered for any other reason, your business receives the cash value.

Deferred compensation that supplements a retirement plan is another option you might consider. Your company would buy a life insurance policy on the life of a key employee. The business is the owner and beneficiary. If the employee dies, the business receives the death benefit tax free. From the benefit proceeds, your business pays an annual sum to the employee’s survivors for a specified period.

Providing group life insurance as an employee benefit can also help your business by attracting and retaining employees. Group insurance is less expensive to purchase than individual insurance. Also, no medical exam may be required, depending on the size of your company. Here, the premiums are tax deductible to your business, and the benefits are paid directly to your employee’s beneficiary.

©2017 Broadridge Investor Communication Solutions, Inc. All rights reserved.

What is a family limited partnership, and will it help reduce estate taxes?

©2017 Broadridge Investor Communication Solutions, Inc. All rights reserved.

Common business succession planning objectives

- Ensure smooth, seamless transfer of ownership

- Transfer business to next generation

- Ensure business continuity

- Retire with income source

- Minimize gift and estate taxes